John Hancock Teams with Chris O’Donnell to Recognize Consumers’ Healthy Steps To Physical, Emotional, and Financial Wellness

Experience the interactive Multimedia News Release here: http://www.multivu.com/players/English/7491151-john-hancock-5-more-now/

"Between filming and family, I know how hard it is to juggle everyday life and still fit in time to take care of my physical and financial health," says

A father of five, O'Donnell knows the benefits of getting your health and wealth in good shape. Today, the actor will head to

Get Your Five More NOW

As part of the

"Knowing your Vitality Age can help you set reasonable goals, and it's a powerful motivator to stay on the road to healthy living," said

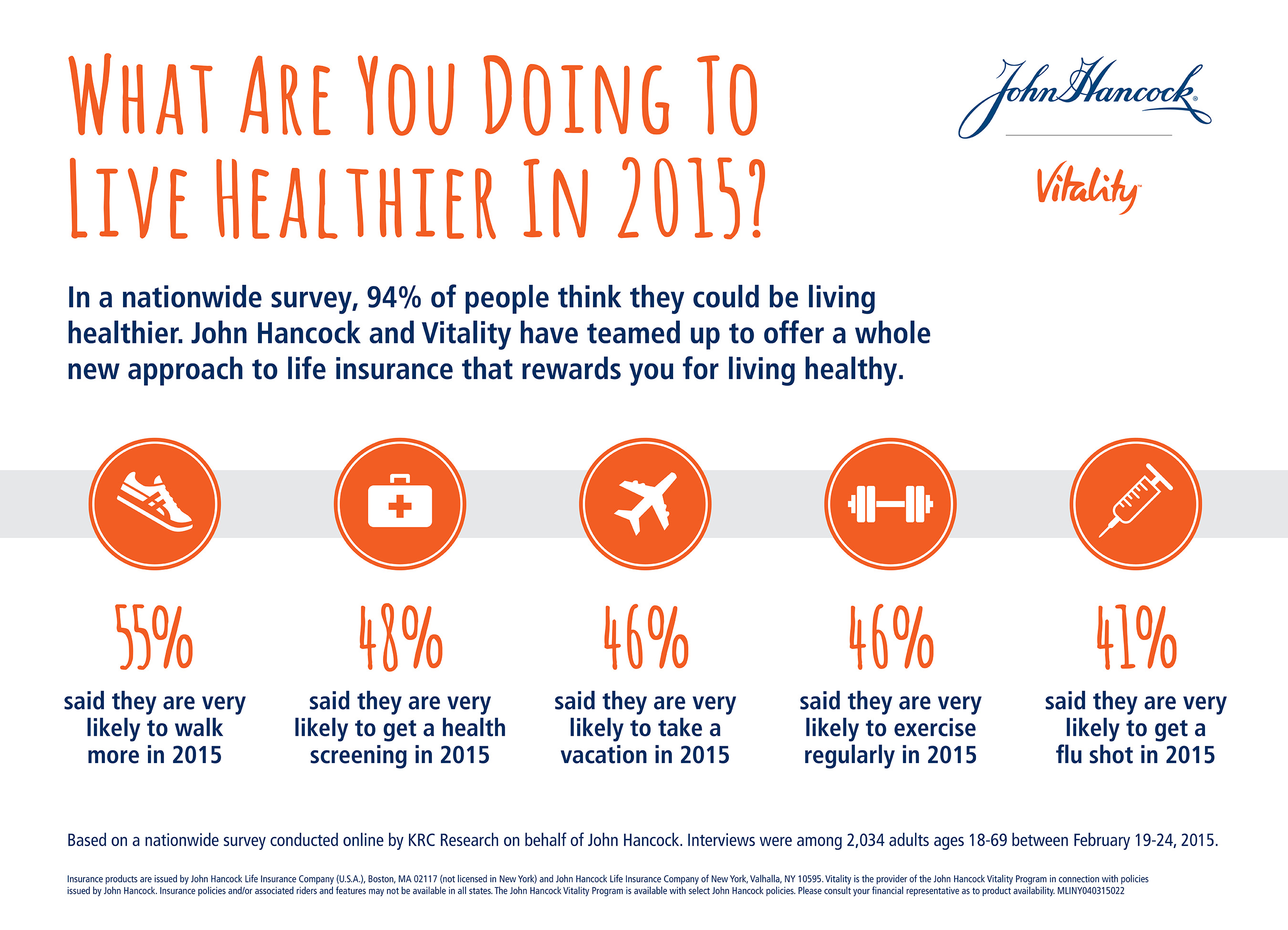

A recent survey of Gen Xers and Baby Boomers, commissioned by John Hancock, revealed that health takes priority in their lives. Nearly all surveyed (94% percent) think they could be living healthier, and more than 50 percent said they are very likely to walk more in 2015.

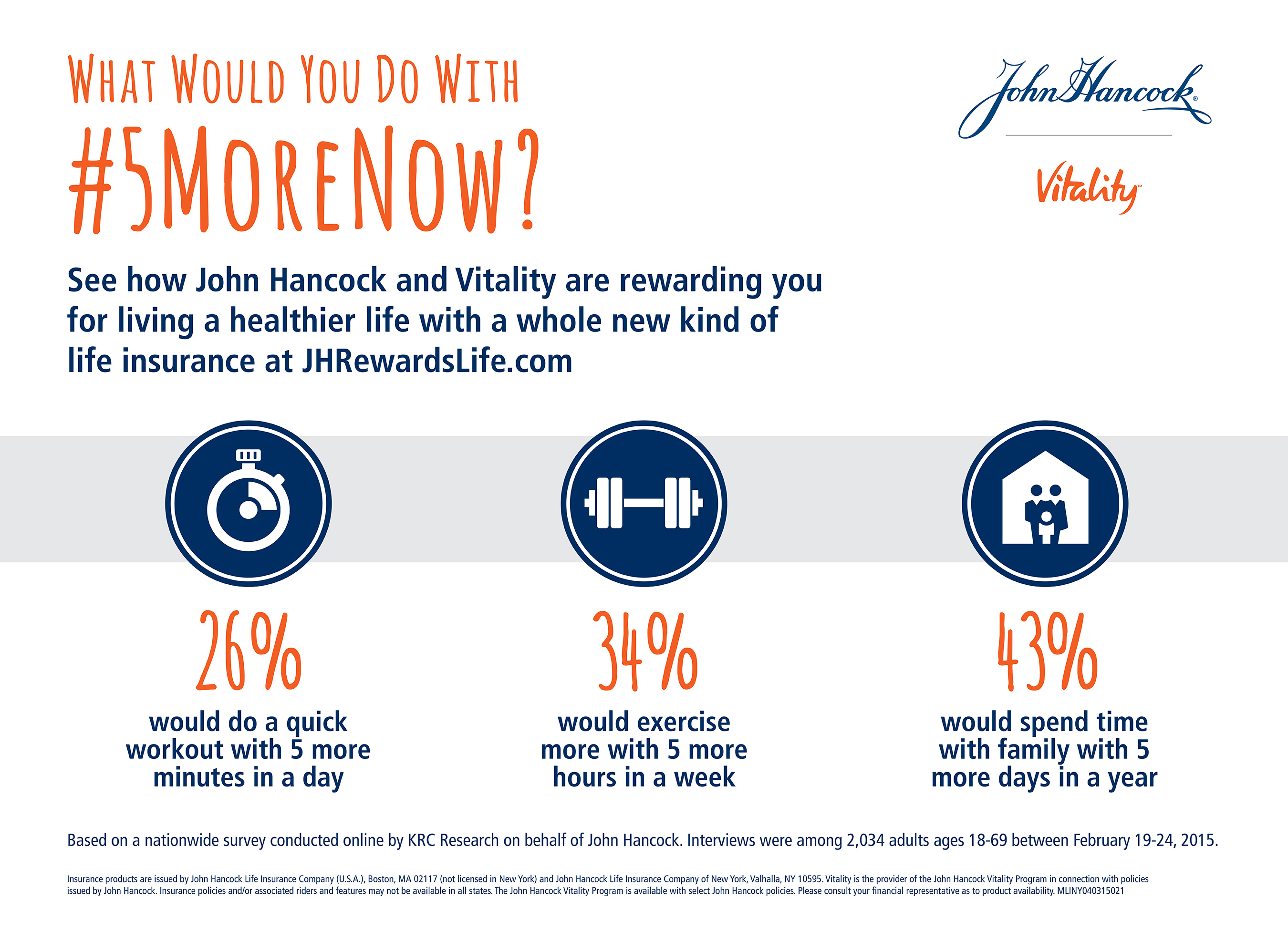

With such busy lives, it's no surprise Americans wish they could get five more--five more minutes, five more hours, even five more days in a year. When asked what they'd do with five more minutes in a day or five more hours in a week, both men and women were most likely to devote the extra time to exercise and physical health. When given the prospect of five extra days in a year, the focus turned to emotional health, with 43% of people saying they would spend the extra time with their family.

Life Insurance that Rewards Healthy Living

John

For example, a 45 year old couple (of average health) buying Protection UL with Vitality life insurance policies of

"The latest advancements in technology are encouraging people to take a more active role in their health," said

The program, which integrates with personalized health technology, including wearables like Fitbit®, offers participants rewards and discounts from major brands such as Amazon, Hyatt, and REI, just for walking, having regular check-ups, and engaging in other everyday healthy activities.

Tune in to JHRewardsLife.com/announcement on

Survey Methodology

This nationwide survey was conducted online by

About John Hancock Financial and Manulife

John Hancock Financial is a division of Manulife, a leading

The John Hancock unit, through its insurance companies, comprises one of the largest life insurers in

About Vitality

Insurance products are issued by

Vitality is the provider of the John Hancock Vitality Program in connection with policies issued by John Hancock.

Insurance policies and/or associated riders and features may not be available in all states. The John Hancock Vitality Program is available with select John Hancock policies. Consumers should consult their financial representative as to product availability and how premium savings may affect the policy they purchase.

John Hancock Vitality Program rewards and discounts are only available to the person insured under the eligible life insurance policy.

Rewards may vary based on the type of insurance policy purchased for the insured (Vitality Program Member), the ownership and inforce status of the insurance policy, and the state where the insurance policy was issued.

MLINY040215016

[1]

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/john-hancock-teams-with-chris-odonnell-to-recognize-consumers-healthy-steps-to-physical-emotional-and-financial-wellness-300062677.html

SOURCE John Hancock Financial

SCHUMER: CRAFT BREWING IS ON THE RISE IN DUTCHESS COUNTY BUT BREWERS NEED ACCESS TO LOCALLY-GROWN MALT BARLEY FOR INDUSTRY TO THRIVE; LOCAL FARMERS…

John Hancock Introduces a Whole New Approach to Life Insurance in the U.S. That Rewards Customers for Healthy Living

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

More Health/Employee Benefits NewsLife Insurance News